策略名称

Combo 2-20 EMA & Bandpass Filter

策略作者

张超

策略描述

This is combo strategies for get a cumulative signal.

First strategy This indicator plots 2/20 exponential moving average . For the Mov Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

Second strategy The related article is copyrighted material from Stocks & Commodities Mar 2010

WARNING:

- For purpose educate only

- This script to change bars colors.

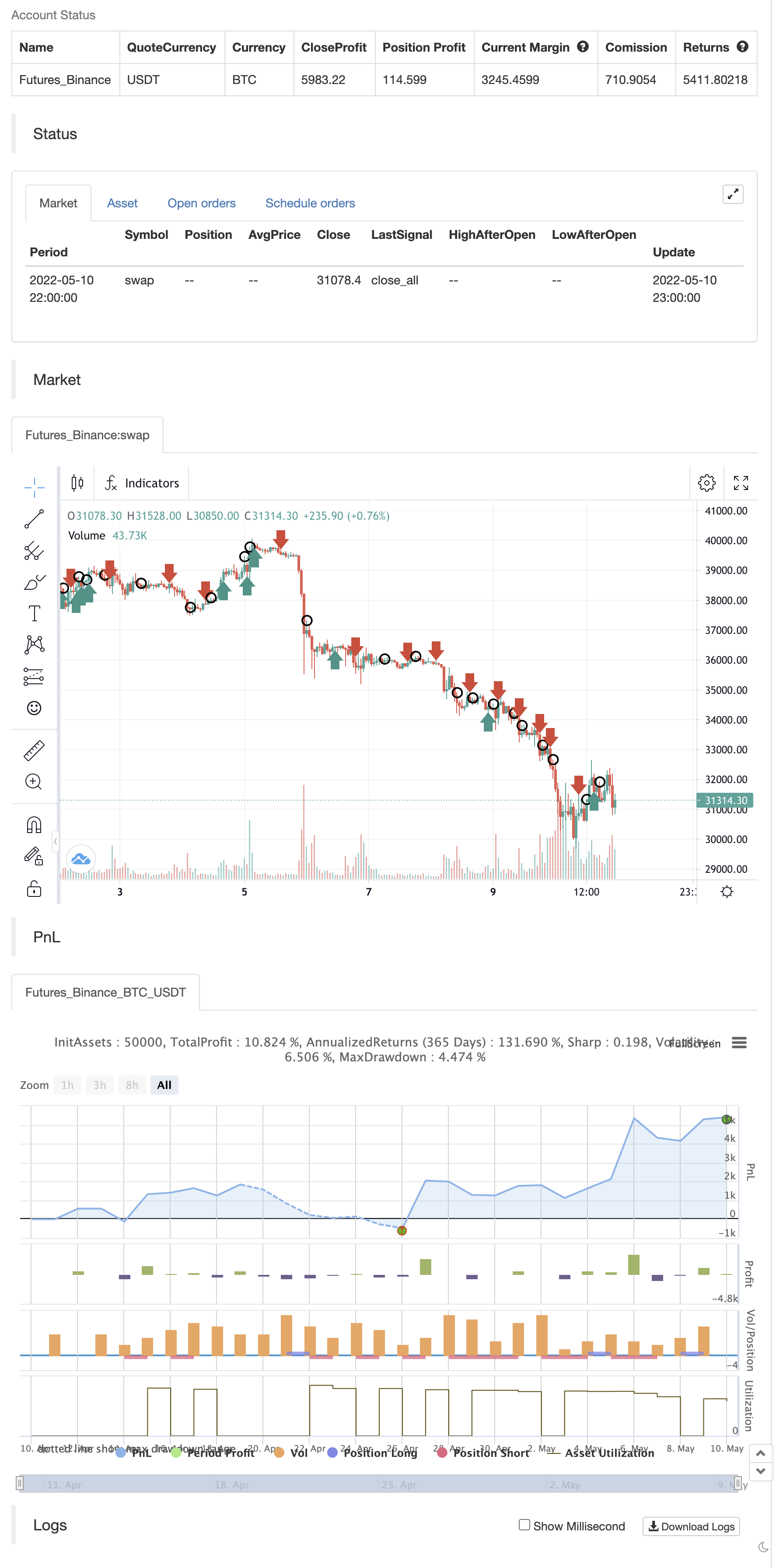

backtest

策略参数

| 参数 | 默认值 | 描述 |

|---|---|---|

| v_input_int_1 | 14 | (?●═════ 2/20 EMA ═════●)Length |

| v_input_int_2 | 20 | (?●═════ Bandpass Filter ═════●)LengthBPF |

| v_input_1 | 0.5 | Delta |

| v_input_float_1 | 5 | SellZone |

| v_input_float_2 | -5 | BuyZone |

| v_input_bool_1 | false | (?●═════ MISC ═════●)Trade reverse |

| v_input_int_3 | true | (?●═════ Time Start ═════●)From Day |

| v_input_int_4 | true | From Month |

| v_input_int_5 | 2005 | From Year |

源码 (PineScript)

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 05/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BPF(Length,Delta,SellZone,BuyZone) =>

pos = 0.0

xPrice = hl2

beta = math.cos(3.14 * (360 / Length) / 180)

gamma = 1 / math.cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - math.sqrt(gamma * gamma - 1)

BP = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos:= BP > SellZone ? 1 :

BP <= BuyZone? -1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bandpass Filter', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Bandpass Filter ═════●'

LengthBPF = input.int(20, minval=1, group=I2)

Delta = input(0.5, group=I2)

SellZone = input.float(5, step = 0.01, group=I2)

BuyZone = input.float(-5, step = 0.01, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBPF = BPF(LengthBPF,Delta,SellZone,BuyZone)

iff_1 = posEMA20 == -1 and prePosBPF == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBPF == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

//barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)策略出处

https://www.fmz.com/strategy/362638

更新时间

2022-05-12 16:09:47