策略名称

Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI

策略作者

张超

策略描述

Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI

Educational Script - Use this tool at your own responsability.

backtest

策略参数

| 参数 | 默认值 | 描述 |

|---|---|---|

| v_input_string_1 | 0 | Coloured MA Type: : HullMA |

| v_input_int_1 | 18 | Coloured MA - Length |

| v_input_1_close | 0 | Coloured MA - Source: close |

| v_input_string_2 | 0 | Fast MA Type: : EMA |

| v_input_int_2 | 21 | Fast MA - Length |

| v_input_string_3 | 0 | Medium MA Type: : EMA |

| v_input_int_3 | 55 | Medium MA - Length |

| v_input_string_4 | 0 | Slow MA Type: : EMA |

| v_input_int_4 | 89 | Slow MA Length |

| v_input_2_close | 0 | 3xMA and Bollinger Source: close |

| v_input_string_5 | 0 | Signal Filter Option : : SuperTrend |

| v_input_3 | false | hideMALines |

| v_input_4 | true | hideSuperTrend |

| v_input_5 | true | hideBollingerBands |

| v_input_6 | true | hideTrendDirection |

| v_input_7 | false | disableFastMAFilter |

| v_input_8 | false | disableMediumMAFilter |

| v_input_9 | false | disableSlowMAFilter |

| v_input_int_5 | 20 | Bollinge Bands Length |

| v_input_float_1 | 2 | Bollinger Bands StdDevs |

| v_input_10 | 8 | Bollinger Outside In LookBack |

| v_input_float_2 | 3.618 | SuperTrend Factor |

| v_input_int_6 | 5 | SuperTrend Length |

| v_input_string_6 | 0 | BUY Marker Colour: : Green |

| v_input_string_7 | 0 | SELL Marker Colour: : Maroon |

| v_input_11 | 70 | overbought value |

| v_input_12 | 30 | oversold value |

| v_input_int_7 | 10 | Length |

| v_input_int_8 | 12 | ROCLength |

| v_input_int_9 | false | Trigger |

源码 (PineScript)

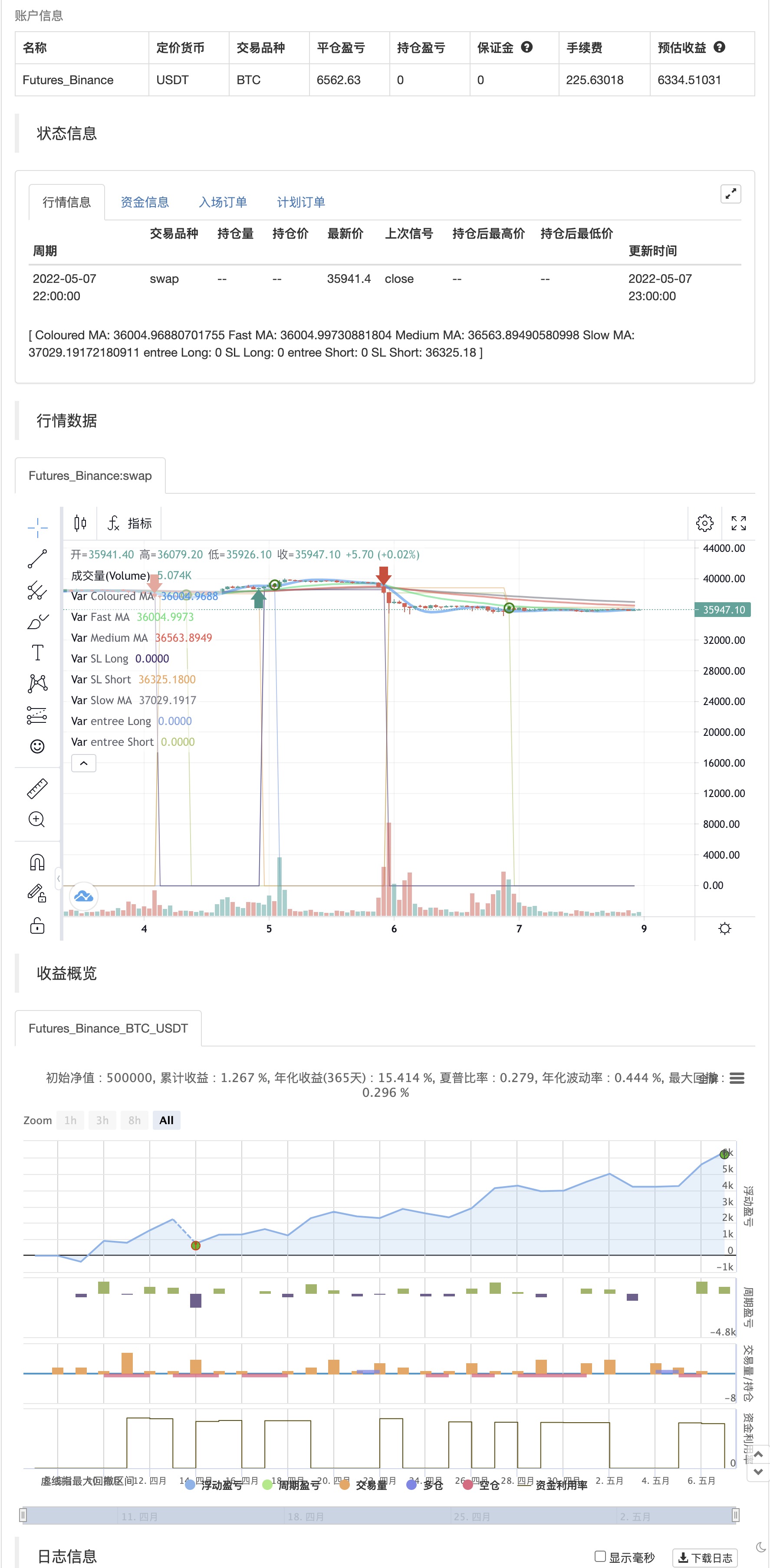

/*backtest

start: 2022-04-08 00:00:00

end: 2022-05-07 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=5

//

// Bannos

// #NotTradingAdvice #DYOR

// Disclaimer.

// I AM NOT A FINANCIAL ADVISOR.

// THESE IDEAS ARE NOT ADVICE AND ARE FOR EDUCATION PURPOSES ONLY.

// ALWAYS DO YOUR OWN RESEARC

strategy(title='Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI', shorttitle='SNAPPER Bannos', overlay=true)

//

// Author: Adaptation from Bannos. Source: JustUncleL

// Date: May-2022

// Version: R1.0

//

// Description:

// This is a diversified Binary Option or Scalping Alert indicator originally designed for

// lower Time Frame Trend or Swing trading. Although you will find it a useful tool for

// higher time frames as well.

//

// The Alerts are generated by the changing direction of the ColouredMA (HullMA by default,

// also SSMA works well) or optionally by fastMA crossing ColouredMA. Then you have the choice of

// selecting the Directional filtering on these signals or a Bollinger Outside IN swing

// reversal filter.

//

// The filters include:

//

// Type 1 - The three MAs (EMAs 21,55,89 by default) in various combinations or by themselves.

// When only one directional MA selected then direction filter is given by ColouredMA

// above(up)/below(down) selected MA.

// If more than one MA selected the direction is given by MAs being in correct order

// for trend direction.

//

// Type 2 - The SuperTrend direction is used to filter ColouredMA signals.

//

// Type 3 - Bollinger Band Outside In is used to filter ColouredMA for swing reversals.

//

// Type 4 - No directional filtering, all signals from the ColouredMA are shown.

//

// Type 5 - Signals given by FastMA (eg length 7) crossing the ColouredMA (eg length 14),

// suggested FastMA should same type as ColouredMA (eq HullMA or SSMA) and

// no less than half the length.

//

// Notes: - Each Type can be combined with most other types to form more complex filtration.

// - Alerts can also be disabled completely if you just want one indicator with

// one colouredMA and/or 3xMAs and/or Bollinger Bands and/or SuperTrend

// painted on the chart.

//

// Warning- Be aware that combining Bollinger OutsideIn swing filter and a directional filter

// can be counter productive as they are opposites. So careful consideration is needed

// when combining Bollinger OutsideIn with any of the directional filters.

//

// Hints: - For Binary Options try ColouredMA = HullMA(13) or HullMA(8) with Type 2 or 3 Filter.

// - When using Trend filters SuperTrend and/or 3xMA Trend, you will find if price reverses

// and breaks back through the Big Fat Signal line, then this can be a good reversal trade.

// - Try using SSMA instead of HullMA for signal line, it is similar to Hull but remains

// smoother at low lengths and works well with the MA Cross signals.

//

// Mofidifications:

//

// R0.# : Original alpha unpublished versions.

//

// R1.# : Original beta unpublished versions.

//

// R2.0 : Original Published version.

//

// R3.0 : - Added new Signal Type 5: Signals come from Fast MA crossing slower ColouredMA.

// - Replaced OutsideIn Coloured MA signals with those generated from the MA cross.

// - Added selectable colours for Big fat marker, the big arrows colours must still

// be selected in the "Style" parameters of the script.

//

// References:

// Some explanation about the what Hull Moving averageis and ideas of how the generated in

// Snapper can be used.

// - https://tradingsim.com/blog/hull-ma/

// - http://forextradingstrategies4u.com/hull-moving-average-forex-trading-strategy/

//

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

//

// Inspiration from @vdubus

//

//

// -----------------------------------------------------------------------------

// Copyright 2017 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

// === INPUTS ===

// Coloured MA - type, length, source

typeColoured = input.string(defval='HullMA', title='Coloured MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenColoured = input.int(defval=18, title='Coloured MA - Length', minval=1)

srcColoured = input(close, title='Coloured MA - Source')

// Fast MA - type, length

typeFast = input.string(defval='EMA', title='Fast MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenFast = input.int(defval=21, title='Fast MA - Length', minval=1)

// Medium MA - type, length

typeMedium = input.string(defval='EMA', title='Medium MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenMedium = input.int(defval=55, title='Medium MA - Length', minval=1)

// Slow MA - type, length

typeSlow = input.string(defval='EMA', title='Slow MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenSlow = input.int(defval=89, title='Slow MA Length', minval=1)

// 3xMA source

ma_src = input(close, title='3xMA and Bollinger Source')

//

filterOption = input.string('SuperTrend', title='Signal Filter Option : ', options=['3xMATrend', 'SuperTrend', 'SuperTrend+3xMA', 'ColouredMA', 'No Alerts', 'MACross', 'MACross+ST', 'MACross+3xMA', 'OutsideIn:MACross', 'OutsideIn:MACross+ST', 'OutsideIn:MACross+3xMA'])

//

hideMALines = input(false)

hideSuperTrend = input(true)

hideBollingerBands = input(true)

hideTrendDirection = input(true)

//

disableFastMAFilter = input(false)

disableMediumMAFilter = input(false)

disableSlowMAFilter = input(false)

//

uKC = false // input(false,title="Use Keltner Channel (KC) instead of Bollinger")

bbLength = input.int(20, minval=2, step=1, title='Bollinge Bands Length')

bbStddev = input.float(2.0, minval=0.5, step=0.1, title='Bollinger Bands StdDevs')

oiLength = input(8, title='Bollinger Outside In LookBack')

//

SFactor = input.float(3.618, minval=1.0, title='SuperTrend Factor')

SPd = input.int(5, minval=1, title='SuperTrend Length')

//

buyColour_ = input.string('Green', title='BUY Marker Colour: ', options=['Green', 'Lime', 'Aqua', 'DodgerBlue', 'Gray', 'Yellow'])

sellColour_ = input.string('Maroon', title='SELL Marker Colour: ', options=['Maroon', 'Red', 'Fuchsia', 'Blue', 'Black', 'Orange'])

// --- Allocate Correct Filtering Choice

// Can only be one choice

uSuperTrendFilter = filterOption == 'SuperTrend' ? true : false

u3xMATrendFilter = filterOption == '3xMATrend' ? true : false

uBothTrendFilters = filterOption == 'SuperTrend+3xMA' ? true : false

//uOIFilter = filterOption == "OutsideIn:ClrMA" ? true : false

uOIMACrossFilter = filterOption == 'OutsideIn:MACross' ? true : false

uOI3xMAFilter = filterOption == 'OutsideIn:MACross+3xMA' ? true : false

uOISTFilter = filterOption == 'OutsideIn:MACross+ST' ? true : false

uMACrossFilter = filterOption == 'MACross' ? true : false

uMACrossSTFilter = filterOption == 'MACross+ST' ? true : false

uMACross3xMAFilter = filterOption == 'MACross+3xMA' ? true : false

// unless all 3 MAs disabled.

disable3xMAFilter = disableFastMAFilter and disableMediumMAFilter and disableSlowMAFilter

u3xMATrendFilter := disable3xMAFilter ? false : u3xMATrendFilter

// if no filters selected then must be "No Filters" option

disableAllFilters = u3xMATrendFilter or uSuperTrendFilter or uBothTrendFilters or uOI3xMAFilter or uOISTFilter or uOIMACrossFilter or uMACrossFilter or uMACrossSTFilter or uMACross3xMAFilter ? false : true

// if "No Alerts" option selected, then disable all selections

disableAllFilters := filterOption == 'No Alerts' ? false : disableAllFilters

uSuperTrendFilter := filterOption == 'No Alerts' ? false : uSuperTrendFilter

u3xMATrendFilter := filterOption == 'No Alerts' ? false : u3xMATrendFilter

uBothTrendFilters := filterOption == 'No Alerts' ? false : uBothTrendFilters

//uOIFilter := filterOption == "No Alerts"? false : uOIFilter

uOIMACrossFilter := filterOption == 'No Alerts' ? false : uOIMACrossFilter

uOI3xMAFilter := filterOption == 'No Alerts' ? false : uOI3xMAFilter

uOISTFilter := filterOption == 'No Alerts' ? false : uOISTFilter

uMACrossFilter := filterOption == 'No Alerts' ? false : uMACrossFilter

uMACrossSTFilter := filterOption == 'No Alerts' ? false : uMACrossSTFilter

uMACross3xMAFilter := filterOption == 'No Alerts' ? false : uMACross3xMAFilter

// --- CONSTANTS ---

dodgerblue = #1E90FF

lightcoral = #F08080

buyColour = color.green // for big Arrows, must be a constant.

sellColour = color.maroon // for big Arrows

// Colour Selectable for Big Fat Bars.

buyclr = buyColour_ == 'Lime' ? color.lime : buyColour_ == 'Aqua' ? color.aqua : buyColour_ == 'DodgerBlue' ? dodgerblue : buyColour_ == 'Gray' ? color.gray : buyColour_ == 'Yellow' ? color.yellow : color.green

sellclr = sellColour_ == 'Red' ? color.red : sellColour_ == 'Fuchsia' ? color.fuchsia : sellColour_ == 'Blue' ? color.blue : sellColour_ == 'Black' ? color.black : sellColour_ == 'Orange' ? color.orange : color.maroon

// === /INPUTS ===

// === FUNCTIONS ===

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = ta.sma(src, len) // Simple

v2 = ta.ema(src, len) // Exponential

v3 = ta.wma(src, len) // Weighted

v4 = ta.vwma(src, len) // Volume Weighted

v5 = 0.0

sma_1 = ta.sma(src, len) // Smoothed

v5 := na(v5[1]) ? sma_1 : (v5[1] * (len - 1) + src) / len

v6 = 2 * v2 - ta.ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ta.ema(v2, len)) + ta.ema(ta.ema(v2, len), len) // Triple Exponential

v8 = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len))) // Hull WMA = (2*WMA (n/2) − WMA (n)), sqrt (n))

v11 = ta.sma(ta.sma(src, len), len) // Triangular

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = math.exp(-1.414 * 3.14159 / len)

b1 = 2 * a1 * math.cos(1.414 * 3.14159 / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1 * (src + nz(src[1])) / 2 + c2 * nz(v9[1]) + c3 * nz(v9[2])

// Zero Lag Exponential

e = ta.ema(v1, len)

v10 = v1 + v1 - e

// return variant, defaults to SMA if input invalid.

type == 'EMA' ? v2 : type == 'WMA' ? v3 : type == 'VWMA' ? v4 : type == 'SMMA' ? v5 : type == 'DEMA' ? v6 : type == 'TEMA' ? v7 : type == 'HullMA' ? v8 : type == 'SSMA' ? v9 : type == 'ZEMA' ? v10 : type == 'TMA' ? v11 : v1

// === /FUNCTIONS ===

// === SERIES VARIABLES ===

// MA's

ma_fast = variant(typeFast, ma_src, lenFast)

ma_medium = variant(typeMedium, ma_src, lenMedium)

ma_slow = variant(typeSlow, ma_src, lenSlow)

ma_coloured = variant(typeColoured, srcColoured, lenColoured)

// Get Direction of Coloured Moving Average

clrdirection = 1

falling_1 = ta.falling(ma_coloured, 2)

clrdirection := ta.rising(ma_coloured, 2) ? 1 : falling_1 ? -1 : nz(clrdirection[1], 1)

// get 3xMA trend direction based on selections.

madirection = ma_fast > ma_medium and ma_medium > ma_slow ? 1 : ma_fast < ma_medium and ma_medium < ma_slow ? -1 : 0

madirection := disableSlowMAFilter ? ma_fast > ma_medium ? 1 : ma_fast < ma_medium ? -1 : 0 : madirection

madirection := disableMediumMAFilter ? ma_fast > ma_slow ? 1 : ma_fast < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter ? ma_medium > ma_slow ? 1 : ma_medium < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter and disableMediumMAFilter ? ma_coloured > ma_slow ? 1 : -1 : madirection

madirection := disableFastMAFilter and disableSlowMAFilter ? ma_coloured > ma_medium ? 1 : -1 : madirection

madirection := disableSlowMAFilter and disableMediumMAFilter ? ma_coloured > ma_fast ? 1 : -1 : madirection

//

// Supertrend Calculations

SUp = hl2 - SFactor * ta.atr(SPd)

SDn = hl2 + SFactor * ta.atr(SPd)

STrendUp = 0.0

STrendDown = 0.0

STrendUp := close[1] > STrendUp[1] ? math.max(SUp, STrendUp[1]) : SUp

STrendDown := close[1] < STrendDown[1] ? math.min(SDn, STrendDown[1]) : SDn

STrend = 0

STrend := close > STrendDown[1] ? 1 : close < STrendUp[1] ? -1 : nz(STrend[1], 1)

Tsl = STrend == 1 ? STrendUp : STrendDown

// Standard Bollinger or KC Bands

basis = ta.sma(ma_src, bbLength)

rangema = ta.sma(ta.tr, bbLength)

stdev_1 = ta.stdev(ma_src, bbLength)

dev = uKC ? bbStddev * rangema : bbStddev * stdev_1

// Calculate Bollinger or KC Channel

upper = basis + dev

lower = basis - dev

// Lookback for previous highest bar index

noiupper = math.abs(ta.highestbars(oiLength))

noilower = math.abs(ta.lowestbars(oiLength))

// ColouredMA OutsideIn

//oiupper = clrdirection<0 and noiupper>0 and highest(oiLength)>upper[noiupper]? 1 : 0

//oilower = clrdirection>0 and noilower>0 and lowest(oiLength)<lower[noilower]? 1 : 0

// MACross OutsideIN

oiMACrossupper = ta.crossunder(ma_fast, ma_coloured) and noiupper > 0 and ta.highest(oiLength) > upper[noiupper] ? 1 : 0

oiMACrosslower = ta.crossover(ma_fast, ma_coloured) and noilower > 0 and ta.lowest(oiLength) < lower[noilower] ? 1 : 0

// === /SERIES VARIABLES ===

// === PLOTTING ===

// All the MA's

plot(ma_coloured, title='Coloured MA', color=clrdirection < 0 ? lightcoral : color.blue, linewidth=3, transp=20)

plot(hideMALines ? na : ma_fast, title='Fast MA', color=color.new(color.lime, 20), linewidth=2)

plot(hideMALines ? na : ma_medium, title='Medium MA', color=color.new(color.red, 10), linewidth=2)

plot(hideMALines ? na : ma_slow, title='Slow MA', color=color.new(color.gray, 10), linewidth=2)

// show 3xMA Trend Direction State.

dcolour = madirection == 1 ? color.green : madirection == -1 ? color.red : color.yellow

plotshape(hideTrendDirection ? na : madirection, title='3xMA Trend Direction', location=location.bottom, style=shape.square, color=dcolour, transp=10)

// SuperTrend

plot(hideSuperTrend ? na : Tsl, color=STrend == 1 ? color.green : color.maroon, style=plot.style_line, linewidth=2, title='SuperTrend')

// Bollinger Bands

p1 = plot(hideBollingerBands ? na : upper, title='BB upper', color=color.new(dodgerblue, 20), linewidth=1)

p2 = plot(hideBollingerBands ? na : lower, title='BB lower', color=color.new(dodgerblue, 20), linewidth=1)

//fill(p1, p2, color=color.new(dodgerblue, 96), title='BB fill')

// === /PLOTTING ===

// === ALERTING ===

// 3xMA Filtering

_3xmabuy = 0

_3xmasell = 0

_3xmabuy := clrdirection == 1 and close > ma_fast and madirection == 1 ? nz(_3xmabuy[1]) + 1 : clrdirection == 1 and madirection == 1 ? nz(_3xmabuy[1]) > 0 ? nz(_3xmabuy[1]) + 1 : 0 : 0

_3xmasell := clrdirection == -1 and close < ma_fast and madirection == -1 ? nz(_3xmasell[1]) + 1 : clrdirection == -1 and madirection == -1 ? nz(_3xmasell[1]) > 0 ? nz(_3xmasell[1]) + 1 : 0 : 0

//

// SuperTrend Filtering

stbuy = 0

stsell = 0

stbuy := clrdirection == 1 and STrend == 1 ? nz(stbuy[1]) + 1 : 0

stsell := clrdirection == -1 and STrend == -1 ? nz(stsell[1]) + 1 : 0

//

// 3xMA & SuperTrend Filtering

//

st3xmabuy = 0

st3xmasell = 0

st3xmabuy := (disable3xMAFilter or _3xmabuy > 0) and stbuy > 0 ? nz(st3xmabuy[1]) + 1 : 0

st3xmasell := (disable3xMAFilter or _3xmasell > 0) and stsell > 0 ? nz(st3xmasell[1]) + 1 : 0

// Bollinger Outside In using ColuredMA direction Filter.

//oibuy = 0

//oisell = 0

//oibuy := clrdirection == 1 and oilower==1? nz(oibuy[1])+1 : 0

//oisell := clrdirection ==-1 and oiupper==1? nz(oisell[1])+1 : 0

// Bollinger Outside In using MACross signal Filter

oiMACrossbuy = 0

oiMACrosssell = 0

oiMACrossbuy := oiMACrosslower == 1 ? nz(oiMACrossbuy[1]) + 1 : 0

oiMACrosssell := oiMACrossupper == 1 ? nz(oiMACrosssell[1]) + 1 : 0

// Bollinger Outside In + 3xMA Filter

oi3xmabuy = 0

oi3xmasell = 0

oi3xmabuy := oiMACrossbuy > 0 and (disable3xMAFilter or madirection == 1) ? nz(oi3xmabuy[1]) + 1 : 0

oi3xmasell := oiMACrosssell > 0 and (disable3xMAFilter or madirection == -1) ? nz(oi3xmasell[1]) + 1 : 0

// Bollinger Outside In + SuperTrend Filter

oistbuy = 0

oistsell = 0

oistbuy := oiMACrossbuy > 0 and STrend == 1 ? nz(oistbuy[1]) + 1 : 0

oistsell := oiMACrosssell > 0 and STrend == -1 ? nz(oistsell[1]) + 1 : 0

// FastMA crossover HullMA and SuperTrend

macrossSTbuy = 0

macrossSTsell = 0

macrossSTbuy := ta.crossover(ma_fast, ma_coloured) and STrend == 1 ? nz(macrossSTbuy[1]) + 1 : 0

macrossSTsell := ta.crossunder(ma_fast, ma_coloured) and STrend == -1 ? nz(macrossSTsell[1]) + 1 : 0

// FastMA crossover HullMA and 3xMA

macross3xMAbuy = 0

macross3xMAsell = 0

macross3xMAbuy := ta.crossover(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == 1) ? nz(macross3xMAbuy[1]) + 1 : 0

macross3xMAsell := ta.crossunder(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == -1) ? nz(macross3xMAsell[1]) + 1 : 0

//

// Check any Alerts set

long = u3xMATrendFilter and _3xmabuy == 1 or uSuperTrendFilter and stbuy == 1 or uBothTrendFilters and st3xmabuy == 1 or uOI3xMAFilter and oi3xmabuy == 1 or uOISTFilter and oistbuy == 1 or uOIMACrossFilter and oiMACrossbuy == 1 or uMACrossSTFilter and macrossSTbuy == 1 or uMACross3xMAFilter and macross3xMAbuy == 1

short = u3xMATrendFilter and _3xmasell == 1 or uSuperTrendFilter and stsell == 1 or uBothTrendFilters and st3xmasell == 1 or uOI3xMAFilter and oi3xmasell == 1 or uOISTFilter and oistsell == 1 or uOIMACrossFilter and oiMACrosssell == 1 or uMACrossSTFilter and macrossSTsell == 1 or uMACross3xMAFilter and macross3xMAsell == 1

//

// If Alert Detected, then Draw Big fat liner

//plotshape(long ? long : na, title='Long Line Marker', location=location.belowbar, style=shape.arrowup, color=buyclr, size=size.auto, text='████████████████', textcolor=buyclr, transp=20)

//plotshape(short ? short : na, title='Short Line Marker', location=location.abovebar, style=shape.arrowdown, color=sellclr, size=size.auto, text='████████████████', textcolor=sellclr, transp=20)

// --- Arrow style signals

// No Filters only Hull Signals

hbuy = 0

hsell = 0

hbuy := clrdirection == 1 ? nz(hbuy[1]) + 1 : 0

hsell := clrdirection == -1 ? nz(hsell[1]) + 1 : 0

// FastMA crossover HullMA

macrossbuy = 0

macrosssell = 0

macrossbuy := ta.crossover(ma_fast, ma_coloured) ? nz(macrossbuy[1]) + 1 : 0

macrosssell := ta.crossunder(ma_fast, ma_coloured) ? nz(macrosssell[1]) + 1 : 0

//

along = disableAllFilters and hbuy == 1 or uMACrossFilter and macrossbuy == 1

ashort = disableAllFilters and hsell == 1 or uMACrossFilter and macrosssell == 1

//

// If ColouredMA or MACross then draw big arrows

//plotarrow(along ? 1 : ashort ? -1 : na, title='ColouredMA or MACross Arrow', colorup=color.new(buyColour, 20), colordown=color.new(sellColour, 20), maxheight=100, minheight=50)

//----------Input Bannos----------------------------------------------------------------------------------------------------------//

var triggerlong = 0

var triggershort = 0

var up = 0

var down = 0

var bool longe = 0

var bool shorte = 0

var SL = 0

var entryvalueup = 0.00

var entryvaluedown = 0.00

var SLfactor = 0.5/100

var SLup = 0.00

var SLdown = 0.00

var longbuffer = 0

var shortbuffer = 0

//RSI parameters

overbought = input(70, title="overbought value")

oversold = input(30, title="oversold value")

sellRsi = ta.rsi(close, 11) > overbought

buyRsi = ta.rsi(close, 11) < oversold

var tampon_overbought = 0

var tampon_oversold = 0

//condition to use RSI

if sellRsi

tampon_overbought := 1

if buyRsi

tampon_oversold := 1

//close condition SL

if entryvalueup > 0 and low < SLup

SL := 1

//Chaikin Volatility Strategy indicator if Volatility > 0 then Long or short, otherweise no

Length = input.int(10, '', minval=1)

ROCLength = input.int(12, '',minval=1)

Trigger = input.int(0, '',minval=0)

hline(0)

hline(Trigger)

xPrice1 = high

xPrice2 = low

xPrice = xPrice1 - xPrice2

xROC_EMA = ta.roc(ta.ema(xPrice, Length), ROCLength)

var pos = 0

if xROC_EMA < Trigger

pos := 1

nz(pos[1], 0)

if xROC_EMA > Trigger

pos := -1

nz(pos[1], 0)

//-----------------------------------------------------------------------------

// plot(xROC_EMA, title="Chaikin Volatility Strategy")

// plot(longe ? 1 : 0, 'longe')

// plot(shorte ? 1 : 0, 'shorte')

plot(entryvalueup, 'entree Long')

plot(SLup, 'SL Long')

plot(entryvaluedown, 'entree Short')

plot(SLdown, 'SL Short')

// plot(entryvalueup, 'entrryvalueup')

// plot(entryvaluedown, 'entrryvaluedown')

// plot(up, 'up')

//plot(down, 'down')

// plot(ta.rsi(close, 11), 'RSI')

// plot(tampon_overbought, 'tampon Overbought')

// plot(tampon_oversold, 'tampon Oversold')

// plot( triggerlong, ' triggerlong')

//plot( triggershort, ' triggershort')

// plot(sellRsi ? 1 : 0, 'sellRsi')

//close condition TP

closelong = (tampon_overbought == 1 and ta.rsi(close, 11) < 63.8 or shorte or SL == 1)

closeshort = (tampon_oversold == 1 and ta.rsi(close, 11) > 36.2 or longe or SL == 1)

//reinit after long Close

if closelong

up := 0

longe := 0

tampon_overbought := 0

triggerlong := 0

SL := 0

entryvalueup := 0

//reinit after short Close

if closeshort

down := 0

shorte := 0

tampon_oversold := 0

triggershort := 0

SL := 0

entryvaluedown := 0

//condition sous sur MA SLOW to start

if close < ma_medium

triggerlong := 0

triggershort := 1

if close > ma_medium

triggershort := 0

triggerlong := 1

// Update alarm conditions

if long or along

longbuffer := 1

if short or ashort

shortbuffer := 1

longe := longbuffer and triggerlong and xROC_EMA > 3.5

shorte := shortbuffer and triggershort and xROC_EMA > 3.5

// // var longe = long ? 1 : 0

// // var shorte = short ? 1 : 0

if longe == 1 and close > open

up := 1

down := 0

entryvalueup :=close

SLup := close - 0.7*(high - low)

SLdown := 0

longbuffer := 0

if shorte == 1 and close < open

down := 1

up := 0

entryvaluedown := close

SLdown := close + 0.7*(high - low)

SLup := 0

shortbuffer := 0

strategy.entry('longe', strategy.long, when = up)

strategy.entry('shorte', strategy.short, when = down)

strategy.close('longe', when= closelong)

strategy.close('shorte', when= closeshort)

// === /ALERTING ===

// === ALARMS ===

//

alertcondition(up or down or closelong or closeshort, title='Signal Alert', message='SIGNAL')

alertcondition(up, title='Long Alert', message='LONG')

alertcondition(down, title='Short Alert', message='SHORT')

alertcondition(closelong, title='close Long Alert', message='Close LONG')

alertcondition(closeshort, title='close Short Alert', message='Close SHORT')

// === /ALARMS ===

//EOF策略出处

https://www.fmz.com/strategy/362055

更新时间

2022-05-09 21:37:30