策略名称

Best TradingView Strategy

策略作者

张超

策略描述

The script is totally based on momentum , volume and price. We have used : 1: Bollinger Band Squeezes to know when a breakout might happen. 2: Used Moving Averages( SMA and EMA ) to know the direction. 3: The success Rate of this strategy is above 75% and if little price action is added it can easily surpass 90% success mark. 4: Do not worry about drawdowns , we have implemented trailing SL ,so you might see a little extra drawdown but in reality its pretty less. 5: I myself have tested this strategy for 41 days with a 250$ account and right now I have 2700$.

backtest

策略参数

| 参数 | 默认值 | 描述 |

|---|---|---|

| v_input_int_1 | 15 | length1 |

| v_input_float_1 | 2 | mult1 |

| v_input_1 | 14 | ADX Smoothing |

| v_input_2 | 14 | DI Length |

| v_input_int_2 | 14 | (?RSI Settings)RSI Length |

| v_input_source_1_close | 0 | Source: close |

| v_input_string_1 | 0 | (?MA Settings)MA Type: SMA |

| v_input_int_3 | 14 | MA Length |

| v_input_float_2 | 2 | BB StdDev |

源码 (PineScript)

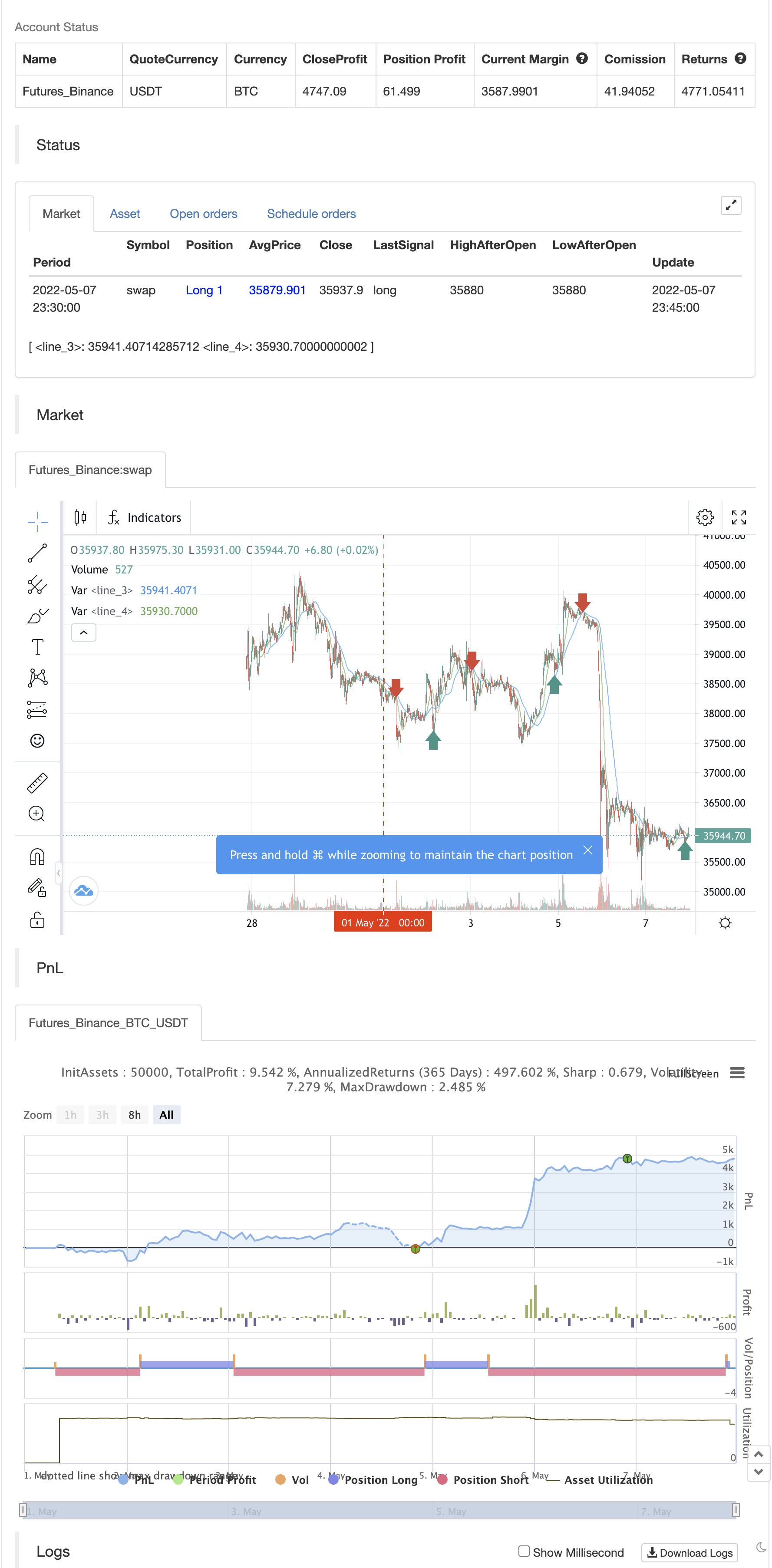

/*backtest

start: 2022-05-01 00:00:00

end: 2022-05-07 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © The_Bigger_Bull

//@version=5

strategy("Best TradingView Strategy", overlay=true, margin_long=0, margin_short=0)

//Bollinger Bands

source1 = close

length1 = input.int(15, minval=1)

mult1 = input.float(2.0, minval=0.001, maxval=50)

basis1 = ta.sma(source1, length1)

dev1 = mult1 * ta.stdev(source1, length1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

//buyEntry = ta.crossover(source1, lower1)

//sellEntry = ta.crossunder(source1, upper1)

//RSI

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

//plot(rsi, "RSI", color=#7E57C2)

//plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

//fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

//fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up1 = ta.change(high)

down1 = -ta.change(low)

plusDM = na(up1) ? na : (up1 > down1 and up1 > 0 ? up1 : 0)

minusDM = na(down1) ? na : (down1 > up1 and down1 > 0 ? down1 : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

out = ta.sma(close, 14)

sma1=ta.sma(close,42)

ema200=ta.ema(close,200)

longCondition = (out>sma1) and ta.crossover(source1, lower1)

if (longCondition )

strategy.entry("long", strategy.long)

shortCondition = (out<sma1) and ta.crossunder(source1, lower1)

if (shortCondition )

strategy.entry("short", strategy.short)

stopl=strategy.position_avg_price-50

tptgt=strategy.position_avg_price+100

stopshort=strategy.position_avg_price+50

tptgtshort=strategy.position_avg_price-100

strategy.exit("longclose","long",trail_offset=50,trail_points=100,when=ta.crossover(sma1,out))

strategy.exit("shortclose","short",trail_offset=50,trail_points=100,when=ta.crossover(out,sma1))

//if strategy.position_avg_price<0

plot(sma1 , color=color.blue)

plot(out, color=color.green)

//plot(ema200,color=color.red)

策略出处

https://www.fmz.com/strategy/362059

更新时间

2022-05-09 21:42:21